reverse sales tax calculator bc

It ranges from 13 in Ontario to 15 in other provinces and is composed of a provincial tax and a. Canadian Sales Taxes From 2012 to 2022.

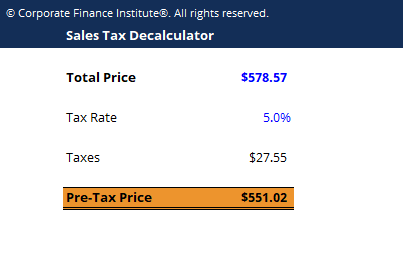

Sales Tax Decalculator Formula To Get Pre Tax Price From Total Price

An online sales tax table for the canadian territories and provinces from year 2012 to 2022.

. There are two options for you to input when using this online calculator. Tax Me is accurate easy to use and helps you quickly calculate Canadian sales tax for any province or territory. Free online 2021 reverse sales tax calculator for Canadian Texas.

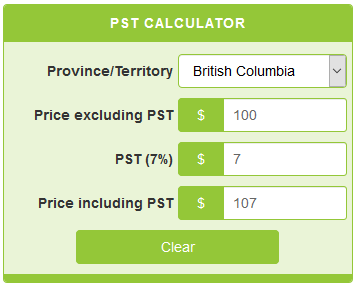

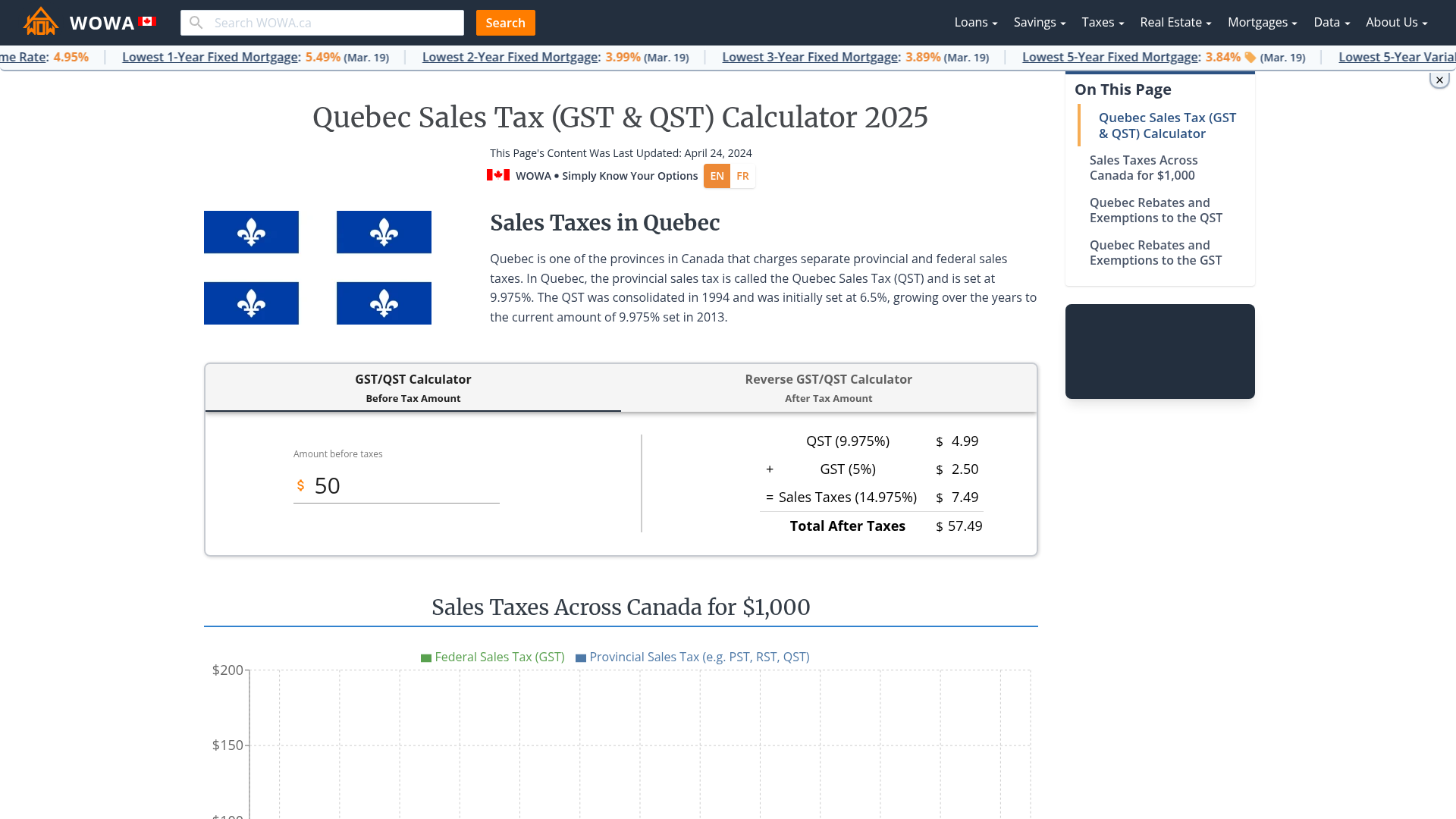

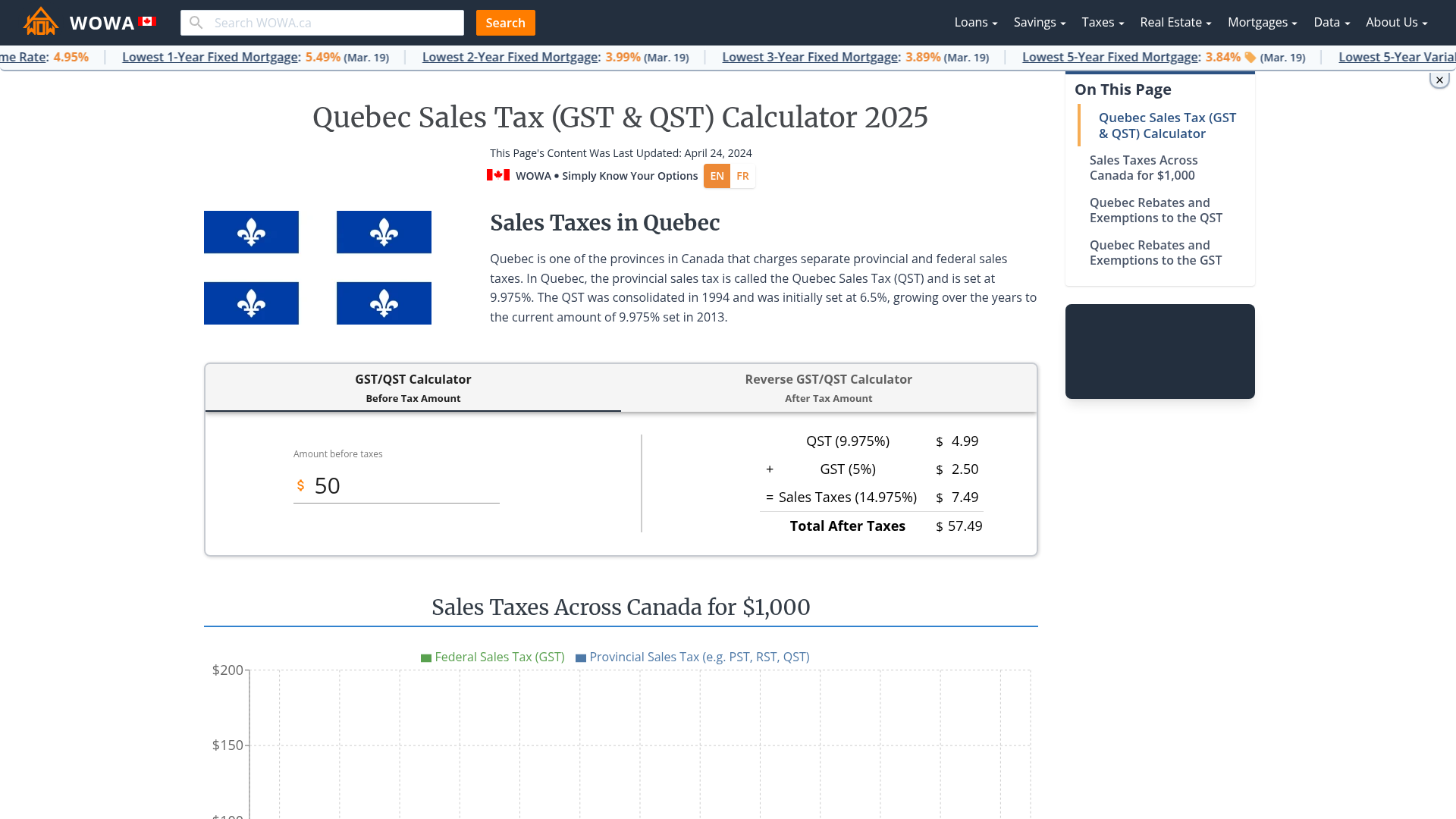

To calculate the total amount and sales taxes from a. Current GST and PST rate for British-Columbia in 2022. Quebec is one of the provinces in Canada that charges separate provincial and federal sales taxes.

British Columbia is one of the provinces in Canada that charges separate 7 Provincial Sales Tax PST and 5 federal Goods and Services Tax GST. The following table provides the GST and HST provincial rates since July 1 2010. Alberta British Columbia BC Manitoba Northwest Territory Nunavut Quebec Saskatchewan Yukon.

Tax rate for all canadian remain the same as in 2017. Updated Canada Sales Tax Calculator. To use the sales tax calculator follow these steps.

Who the supply is made to to learn about who may not pay the GSTHST. In Québec it is called QST. You must use the 9975 rate to calculate the QST if your cash register calculates the GST and QST in two steps that is if it calculates 5 GST on the sale price then also.

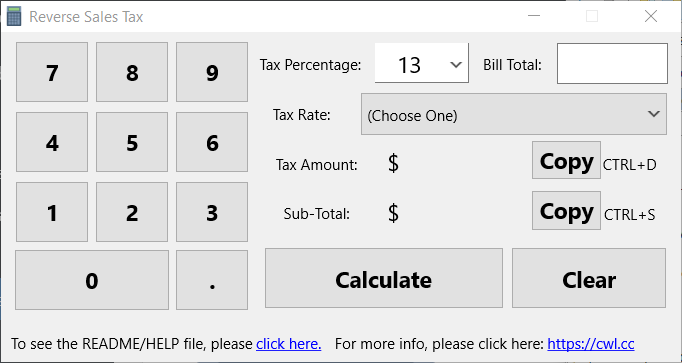

Reverse Sales Tax Rates Calculator Canadian Provinces and Territories An online reverse sales tax Remove Sales tax calculation for residents of canadian territories and provinces. 50 if manufactured mobile home. Tax Amount Original Cost - Original Cost 100 100 GST or HST or PST Amount.

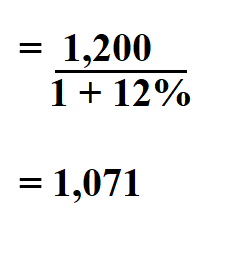

The following table provides the GST and HST provincial rates since July 1 2010. For the first option enter the Sales Tax percentage and the Net Price of the item which is a monetary value. This reverse tax calculator will help you to know the purchasesell amount before and after tax apply.

Provinces and Territories with GST. 45 if portable building. Current HST GST and PST rates table of 2022.

Date Difference Calculator. 7 PST is charged on. The reverse sales tax calculator exactly as you see it above is 100 free for you to use.

For more information please read BC manufactured buildings PST. GSTPST Calculator Before Tax Amount. The rate you will charge depends on different factors see.

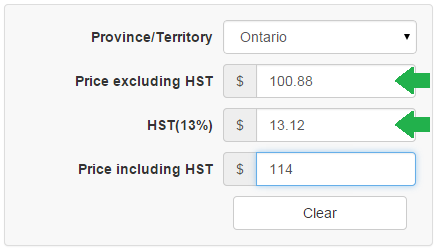

The second tab lets you calculate the taxes from a grand total including tax and gives you the subtotal before tax. New Brunswick Newfoundland and Labrador Nova Scotia Ontario and Prince Edward Island. Sales Tax Calculators Canada Reverse Sales Tax Calculator.

Amount without sales taxes x. See the article. The only thing to remember in our Reverse Sales.

Each province has their own set of tax brackets which can differ from the federal tax brackets. Here is how the total is calculated before sales tax. For the second option enter the Sales Tax percentage and the Gross Price of the item which is a monetary value.

Canada Sales Tax Chart Date Difference Calculator. British Columbia Manitoba Québec and Saskatchewan. Where the supply is made learn about the place of supply rules.

Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax. This follows the previous decrease from 8 to 7 on July 1st 2019. 7 of 45 50 or 55 of the purchase or lease.

Formula for calculating reverse GST and PST in BC. GSTRST Calculator Before Tax Amount. Enter that total price into price including hst input box at the bottom of calculator and you will get excluding hst value and hst value.

If youre looking for a reverse GST-only calculator the above is a great tool to use. 55 if manufactured modular home. Reverse sales tax calculator bc.

Tax Me is accurate easy to use and helps you quickly calculate Canadian sales tax for any province or territory. If your total receipt amount was 5798 and you paid 107 percent in sales tax youd simply plug those numbers into our calculator to find out that your original price before tax was 5737. Current Provincial Sales Tax PST rates are.

The QST was consolidated in 1994 and was initially set at 65 growing over the years to the current amount of 9975 set in 2013. In Quebec the provincial sales tax is called the Quebec Sales Tax QST and is set at 9975. Just set it to the GST Only setting and enter in the after-tax dollar amount.

The previously announced RST rate reduction from 7 to 6 that were effective July 1 2020 have all been deferred until further notice. Reverse GST Calculator. Amount with sales tax 1 GST and PST rate combined100 Amount without sales tax Amount with sales taxes x GST rate100 Amount of GST in BC.

Reverse GSTRST Calculator After Tax Amount. Only four Canadian provinces have PST Provincial Sales Tax. Most goods and services are charged both taxes with a number of exceptions.

This reverse tax calculator will help you to know the purchasesell amount before and after tax apply. Amount without sales tax GST rate GST amount. This simple PST calculator will help to calculate PST or reverse PST.

Reverse GSTPST Calculator After Tax Amount. On March 23 2017 the Saskatchewan PST as raised from 5 to 6. The global sales tax for Bc is calculated from provincial sales tax PST BC rate 7 and the goods and services tax GST in Canada rate 5 for a total of 12.

04 PST on the purchase of energy products. Harmonized Sales Tax HST The Harmonized Sales Tax or HST is a sales tax that is applied to most goods and services in a number of Canadian provinces. From there it is a simple subtraction problem to figure out that you paid 61 cents in sales tax.

Useful for figuring out sales taxes if you sell products with tax included or if you want to extract tax amounts from grand totals. If youre looking for a reverse gst only calculator the above is a great tool to use. New Changes to the Retail Sales Tax 2020.

Amount without sales tax QST rate QST amount. This free calculator is handy for determining sales taxes in canada. Type of supply learn about what supplies are taxable or not.

This will give you the items pre-tax cost.

How To Calculate Sales Tax Backwards From Total

Reverse Hst Calculator Hstcalculator Ca

Reverse Sales Tax Calculator Gst And Qst Calendrier Live

Canada Sales Tax Calculator By Tardent Apps Inc

Bc Sales Tax Gst Pst Calculator 2022 Wowa Ca

Updated Canada Sales Tax Calculator For Pc Mac Windows 11 10 8 7 Iphone Ipad Mod Download 2022

Updated Canada Sales Tax Calculator For Pc Mac Windows 11 10 8 7 Iphone Ipad Mod Download 2022

Reverse Gst Hst Pst Qst Calculator 2022 All Provinces In Canada

Quebec Sales Tax Gst Qst Calculator 2022 Wowa Ca

How To Calculate Sales Tax Backwards From Total

Canada Sales Tax Gst Hst Calculator Wowa Ca

Washington Dc Sales Tax Calculator Reverse Sales Dremployee

Updated Canada Sales Tax Calculator For Pc Mac Windows 11 10 8 7 Iphone Ipad Mod Download 2022

Sales Tax Canada Calculator On The App Store